News

Structured invoice

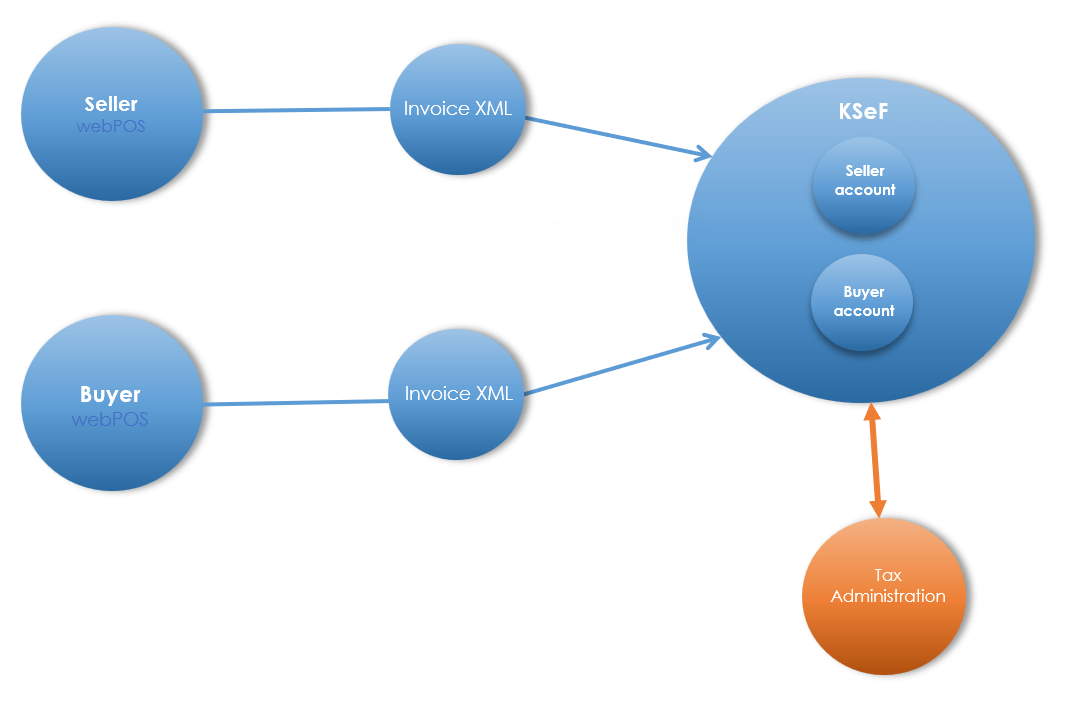

However, it is high time to get to know the structured invoice ( e-invoice). In the Act of 29 October 2021 amending the Act on value added tax and certain other acts (Journal of Laws item 2076), introduced a major amendment to the Act of 11 March 2004 on value added tax (Journal of Laws from 2021 item 685, as amended). A decision has been made to establish National e-Invoicing System. It is abbreviated to KSeF. This change introduces the possibility to issue structured invoices, which allows for a new form of transaction documentation.

Currently traditional (paper) invoices and e-invoices are used in business transactions.

From 1 January 2022, issuing structured invoices in the KSeF system is permitted, but it is optional.

The situation is going to change starting from Q2 2023, when the obligation to use the KSeF is planned. A structured invoice is a document issued by a computer software, for example, webPos, while combining with KSeF, which assigns a number identifying the invoice. The structured invoice is issued by the seller using KseF, it is also received by the buyer using KseF. The webPOS software has an interface module for the KSeF. As a result, after issuing the invoice to a customer, it is automatically sent to the KseF, where it is registered. The KSeF sends back to the webPOS an Official Confirmation of Receipt. From that moment, the document is assigned a unique identifier and a buyer invoice can be issued.